However, it is also essential to balance this with the level of fixed costs – a business with high fixed costs will need a higher CM ratio to break even. Some limitations of the contribution margin include the exclusion of fixed costs that may be direct in nature. For instance, a company spending a large amount on purchasing a new production machine would be considered a fixed cost in the contribution margin analysis. It means a business can use this formula to analyze the revenue left to cover fixed costs.

- Year 1 and onward—we’ll assume that each line item will grow by the following figures (i.e., step function).

- Paul Boyce is an economics editor with over 10 years experience in the industry.

- The contribution margin is revenue minus the variable costs of a business.

- We’ll next calculate the contribution margin and CM ratio in each of the projected periods in the final step.

- Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost.

Limitations of the Operating Margin

However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000. This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced. Such fixed costs are not considered in the contribution margin calculations. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. The contribution margin is computed as the selling price per unit, minus the variable cost per unit.

Additional Resources

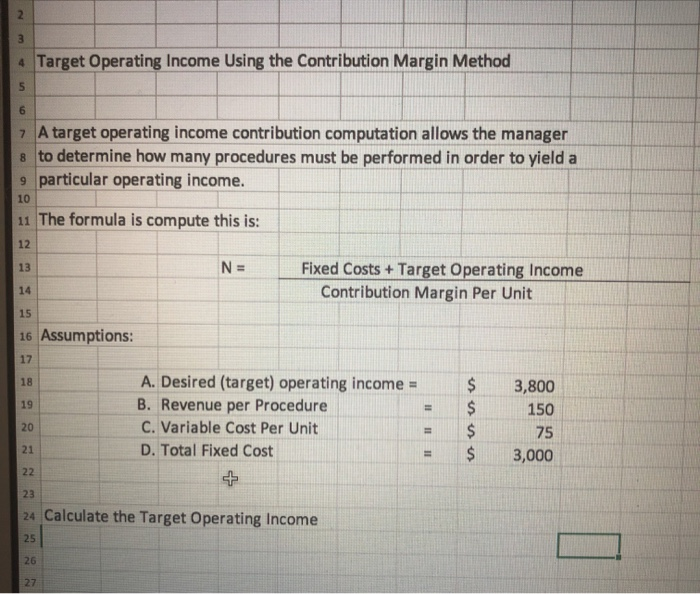

Operating income is also the net income before any nonoperating items such as interest revenue, interest expense, gain or loss on the sale of plant assets, etc. Management uses the contribution margin in several different forms to production and pricing decisions within the business. This concept is especially helpful to management in calculating the breakeven point for a department or a product line. Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues.

To Ensure One Vote Per Person, Please Include the Following Info

Therefore, it is not advised to continue selling your product if your contribution margin ratio is too low or negative. This is because it would be quite challenging for your business to earn profits over the long-term. The contribution margin ratio is also known as the profit volume ratio. This is because it indicates the rate of profitability of your business. The gross sales revenue refers to the total amount your business realizes from the sale of goods or services. That is it does not include any deductions like sales return and allowances.

Contribution margin (presented as a % or in absolute dollars) can be presented as the total amount, amount for each product line, amount per unit, or as a ratio or percentage of net sales. You might wonder why a company would trade variable costs for fixed costs. One reason might be to meet company goals, such as gaining market share. Other reasons include being a leader in the use of innovation and improving efficiencies. If a company uses the latest technology, such as online ordering and delivery, this may help the company attract a new type of customer or create loyalty with longstanding customers.

The Financial Modeling Certification

The contribution margin may also be expressed as a percentage of sales. When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). If the contribution margin for an ink pen is higher than that of a ball pen, the former will be given production preference owing to its higher profitability potential. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them.

EBITDA is sometimes used as a proxy for operating cash flow because it excludes non-cash expenses, such as depreciation. This is because it does not adjust for any increase in working capital or account for capital expenditure that is needed to support production and maintain a company’s asset base—as operating cash flow does. The contribution margin ratio represents the marginal benefit of producing one more unit. Before you begin your calculations, you’ll need to understand fixed and variable expenses. Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin.

The answer to this equation shows the total percentage of sales income remaining to cover fixed expenses and profit after covering all variable costs of producing a product. The contribution margin is a cost accounting concept that lets a company know how much each unit sold contributes to covering fixed costs after all variable costs have been paid. It can be calculated on a per-unit basis, or as a ratio, often expressed as a percentage. The break even point (BEP) is the number of units at which total revenue (selling price per unit) equals total cost (fixed costs + variable cost). If the selling price per unit is more than the variable cost, it will be a profitable venture otherwise it will result in loss. The contribution margin ratio (CM ratio) is an important financial metric that shows how a company’s sales affect its profitability.

If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. The insights derived post-analysis can determine the optimal pricing per product based on the implied incremental impact that each potential adjustment could have on its growth profile and profitability. The companies that operate near peak operating efficiency are far more likely to obtain an economic moat, contributing toward the long-term generation of sustainable profits. You need to fill in the following inputs to calculate the contribution margin using this calculator. Accordingly, the per-unit cost of manufacturing a single packet of bread consisting of 10 pieces each would be as follows. Contribution margin ratio is equal to contribution margin divided by sales.

Also, you can use the contribution per unit formula to determine the selling price of each umbrella. Variable costs are direct and indirect expenses incurred by a business from producing and selling goods or services. These costs vary depending on the volume of units produced or services rendered. Variable costs rise as production increases and falls as the volume of output decreases. High CM ratios are generally desirable because they indicate that a large portion of each sale contributes to covering fixed costs and profit.

Thus, the following structure of the contribution margin income statement will help you to understand the contribution margin formula. The operating margin measures how much profit a company makes on a dollar of sales after paying for variable costs of production, such as wages and raw materials, but before paying interest or tax. It is calculated by dividing a company’s period cost vs product cost period cost examples and formula video and lesson transcript operating income by its net sales. Higher ratios are generally better, illustrating the company is efficient in its operations and is good at turning sales into profits. The contribution margin ratio is a formula that calculates the percentage of contribution margin (fixed expenses, or sales minus variable expenses) relative to net sales, put into percentage terms.